All About Offshore Trust Services

The Main Principles Of Offshore Trust Services

Table of ContentsSome Known Factual Statements About Offshore Trust Services Some Ideas on Offshore Trust Services You Should KnowThe 45-Second Trick For Offshore Trust ServicesThe Ultimate Guide To Offshore Trust ServicesOffshore Trust Services Things To Know Before You Get ThisGetting My Offshore Trust Services To WorkThe Only Guide to Offshore Trust ServicesThe 8-Minute Rule for Offshore Trust Services

Exclusive financial institutions, also bigger personal firms, are more amendable to resolve collections against debtors with complicated as well as efficient possession protection plans. There is no possession protection strategy that can hinder a very encouraged lender with unlimited money and also persistence, yet a properly designed overseas depend on often gives the debtor a favorable settlement.Offshore counts on are not for everyone. For some people encountering difficult lender troubles, the overseas trust is the ideal alternative to protect a substantial quantity of possessions.

Debtors may have much more success with an offshore depend on plan in state court than in a bankruptcy court. Judgment lenders in state court litigation might be frightened by offshore property defense counts on and also might not seek collection of possessions in the hands of an overseas trustee. State courts do not have jurisdiction over overseas trustees, which indicates that state courts have restricted remedies to order conformity with court orders.

Some Known Incorrect Statements About Offshore Trust Services

A personal bankruptcy debtor have to surrender all their assets and also lawful interests in property anywhere held to the personal bankruptcy trustee. A United state bankruptcy judge may oblige the personal bankruptcy borrower to do whatever is needed to turn over to the insolvency trustee all the borrower's possessions throughout the globe, consisting of the debtor's helpful rate of interest in an offshore depend on.

Offshore possession defense depends on are less efficient versus internal revenue service collection, criminal restitution judgments, as well as family members support obligations. 4. Also if an U.S. court does not have jurisdiction over overseas trust assets, the U.S. court still has personal jurisdiction over the trustmaker. The courts may try to compel a trustmaker to dissolve a trust fund or restore count on properties.

The trustmaker needs to be ready to surrender legal rights as well as control over their trust assets for an offshore depend properly safeguard these assets from U.S. judgments. 6. Choice of a professional and also trusted trustee who will protect an overseas trust is more vital than selecting an overseas trust fund territory.

Some Ideas on Offshore Trust Services You Need To Know

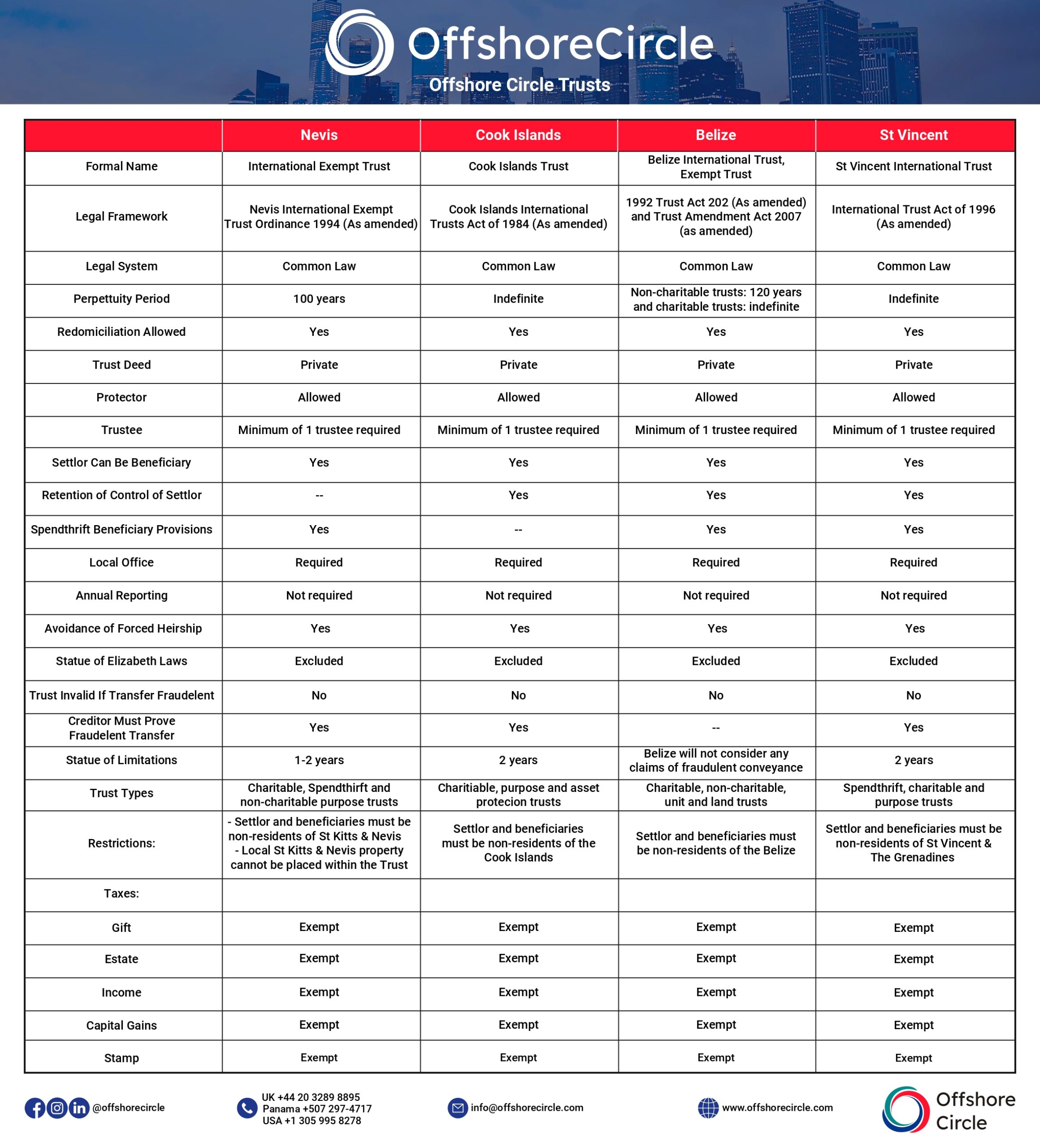

Each of these countries has trust fund statutes that are favorable for offshore asset defense. There are refined lawful differences among offshore trust territories' laws, however they have extra functions alike. The trustmaker's selection of nation depends mostly on where the trustmaker feels most comfortable positioning properties. Tax obligation therapy of international overseas trusts is really specialized.

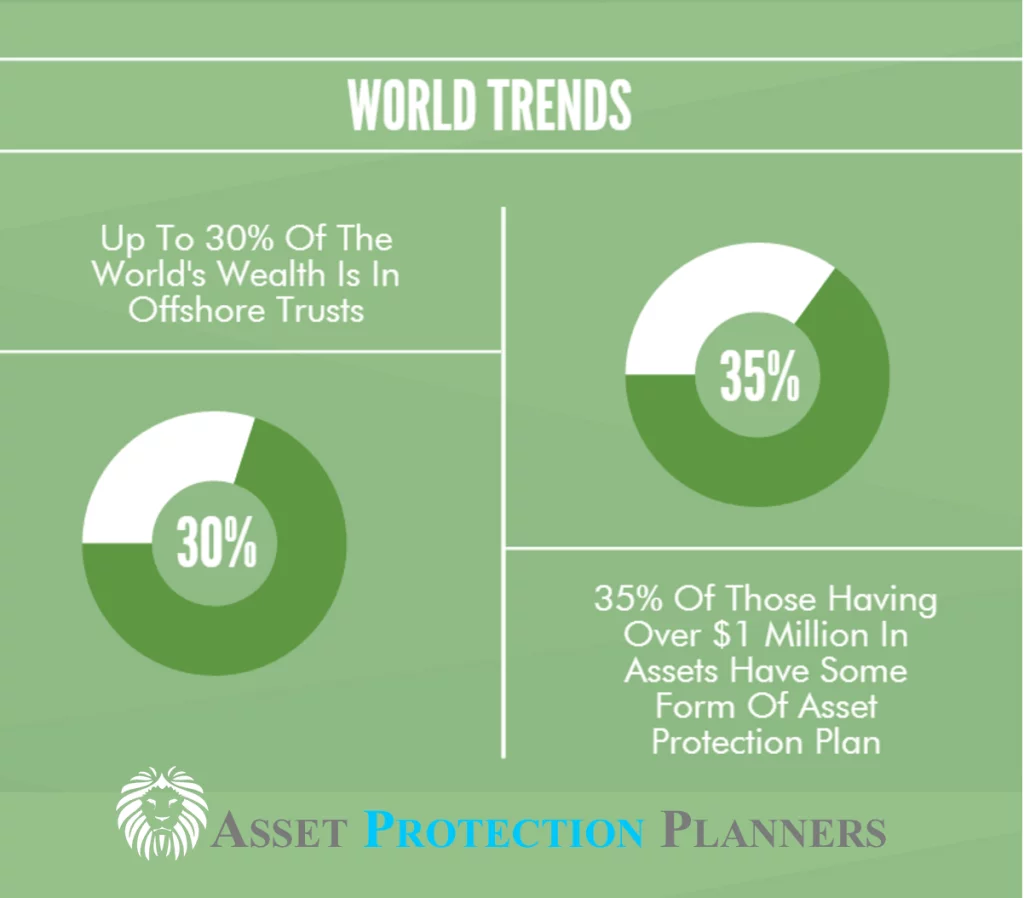

Authorities stats on depends on are tough to come by as in a lot of offshore territories (and in the majority of onshore territories), trust funds are not called for to be registered, nonetheless, it is believed that the most usual use of overseas depends on is as component of the tax and also economic planning of wealthy individuals and their families.

How Offshore Trust Services can Save You Time, Stress, and Money.

In an Unalterable Offshore Depend on might not be altered or liquidated by the settlor. A makes it possible for the trustee to choose the circulation of earnings for different courses of recipients. In a Fixed count on, the distribution of income to the recipients is taken care of and can not be transformed by trustee.

Privacy and privacy: Despite the fact that an offshore depend on is formally signed up in the government, the celebrations of the trust, properties, as well as the problems of the count on are not videotaped in the register. Tax-exempt standing: Assets that are transferred to an offshore trust fund (in a tax-exempt overseas area) are not strained either when moved to the depend on, or when moved or redistributed to the beneficiaries.

More About Offshore Trust Services

This has additionally been done in a variety of united state states. Rely on general are subject to the regulation in which supplies (briefly) that where depend on home consists of the shares of a firm, after that the trustees must take a favorable duty in the events on the firm. The rule has been criticised, yet stays part of depend on legislation in lots of usual legislation territories.

Paradoxically, these specialised kinds of trust funds seem to infrequently be used in regard to their initial designated usages. Celebrity trusts appear to be made use of a lot more often by hedge funds developing mutual funds as unit depends on (where the fund supervisors want to get rid of any type of commitment to participate in meetings of the companies in whose protections they spend) and VISTA counts on are often used as a component of orphan frameworks in bond issues where the trustees desire to separation themselves from managing the issuing lorry.

Specific jurisdictions (especially the Chef Islands, yet the Bahamas Has a variety of asset defense depend on) have provided unique depends on which are styled as possession defense trusts. While all trusts have an possession defense aspect, some territories have enacted legislations attempting to make life challenging for creditors to press cases against the trust (as an example, by offering particularly short restriction durations). An overseas trust is a device made use of for property defense and also estate preparation that functions by transferring assets into the control of a legal entity based in another nation. Offshore depends on are irreversible, so trust proprietors can't reclaim possession of transferred properties. They are likewise made complex as well as expensive. For individuals with higher liability worries, offshore trusts can supply security as well as greater personal privacy as well as some tax obligation advantages.

Offshore Trust Services Can Be Fun For Anyone

Being offshore includes a layer of defense and privacy in addition to the capacity to manage tax obligations. For instance, since the counts on are not situated in the USA, they do not need to follow U.S. legislations or the judgments of united state courts. This makes it much more tough for financial institutions as well as plaintiffs to seek go to my blog cases versus properties kept in overseas trusts.

It can be tough for 3rd parties to establish the assets as well as proprietors of overseas depends on, which makes them aid to personal privacy. In order to establish an offshore count on, the initial step is to pick an international country in which to situate the trusts. Some preferred places include Belize, the Chef Islands, Nevis and Luxembourg.

All about Offshore Trust Services

Move the possessions that are to be protected right into the trust. Depend on owners might first develop a restricted liability business (LLC), transfer assets to the LLC and also then transfer the more information LLC to the trust fund. Offshore depends on can be useful for estate preparation and property protection however they have limitations.

Incomes by possessions positioned in an offshore trust are totally free of United state tax obligations. U.S. owners of offshore trusts also have to submit records with the Internal Profits Service.

Offshore Trust Services Fundamentals Explained

Corruption can be a concern in some countries. On top of that, it's vital to choose a nation that is not likely to experience political agitation, regimen modification, economic upheaval or fast changes to tax policies that could make an offshore count on much less helpful. Possession security depends on usually have actually to be developed prior to they are needed.

They likewise do not completely safeguard against all cases as well as might subject owners to risks of corruption and political instability in the host nations. Nonetheless, overseas depends on are handy estate planning and also possession security devices. Recognizing the right time to use a details depend on, and Learn More which depend on would give the most benefit, can be complicated.

An Offshore Trust fund is a normal Trust fund formed under the regulations of nil (or reduced) tax Global Offshore Financial Facility. A Count on is a lawful strategy (comparable to an arrangement) whereby one individual (called the "Trustee") according to a succeeding individual (called the "Settlor") grant recognize and also hold the building to assist different people (called the "Beneficiaries").